Maximizing Employee Retention in the Banking Industry

Understanding the Real Reasons for Attrition and Using Rewards Programs to Drive Retention

Employee retention is a significant challenge for HR leaders in the banking industry. It’s crucial to uncover the true reasons behind low retention rates and address them effectively. While it may be tempting to attribute employee departures to inadequate compensation, the reality goes much deeper. Let’s explore the real reasons employees quit and how banking HR leaders can enhance their rewards programs to improve retention.

Understanding the Real Reasons for Employee Attrition

Stephanie’s decision to quit her job after three years is a familiar scenario in the banking industry. Despite the common assumption that employees leave for higher compensation, the underlying reasons often revolve around their sense of value and belonging within the organization. Studies have shown that employees leave primarily due to:

- Not feeling valued by the organization

- Not feeling valued by their manager

- Lacking a sense of belonging

To gain a complete understanding of these reasons, HR leaders must overcome the flaws in their exit interview processes. Employees leaving a company are disincentivized to discuss the real issues affecting their decision. They fear uncomfortable conversations, offending someone, or burning bridges. Thus, they often opt for citing higher compensation as the primary reason, which avoids conflicts and concludes the conversation swiftly.

Moreover, traditional exit interviews conducted by HR associates may not delve deep enough to uncover nuanced concerns. These associates may lack a comprehensive understanding of the employee’s role, social dynamics within their team, or previously raised concerns. They are focused on completing the exit interview quickly and comfortably, without the motivation to probe deeper into the employee’s grievances. In some cases, HR may prefer to cite salary as the main reason to avoid addressing more complex issues related to organizational culture, growth opportunities, or psychological safety.

Improving Rewards Programs to Enhance Retention

To gain meaningful insights and improve future retention, HR leaders in the banking industry need to rethink their approach to employee feedback and rewards programs. Here are key strategies to consider:

- Timely Rewards Delivery: Building on the importance of timing discussed earlier, it’s crucial to deliver rewards promptly after employees demonstrate desired behaviors. Partnering with modern technology providers like Whistle Systems can facilitate seamless and immediate rewards delivery, enhancing their impact.

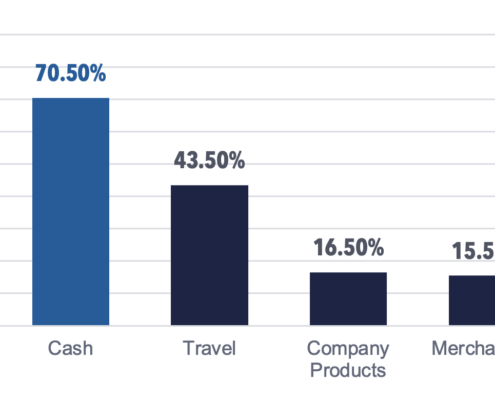

- Personalized Rewards: Instead of offering generic points or merchandise, consider delivering cash rewards directly to employees’ mobile devices. This empowers them to choose rewards that hold personal meaning, fostering a sense of value and appreciation.

- Frequent Rewards and Recognition: Small, frequent rewards provided in the moment have a significant impact on reinforcing positive behaviors and fostering a sense of belonging. Empower supervisors to have a “team budget” that allows them to identify meaningful rewards for their team members.

- Enhanced Onboarding: Recognize that onboarding is the first step towards retention. Invest in creating a positive and engaging onboarding experience to set the tone for employees’ long-term satisfaction and productivity. Avoid treating onboarding as a mere formality and prioritize its importance.

- Empowering Supervisors: Provide comprehensive training to supervisors on effective people management tools and strategies. Focus on small, “micro” segments of training that are easily accessible on mobile devices. Equipped with the right skills, supervisors can make a substantial impact on employee retention.

- Pulse Checks and Anonymous Feedback: Leverage technology tools, such as Whistle, to conduct regular “pulse checks” and collect anonymous feedback from employees. This helps identify areas of strength and weakness in the work experience, enabling proactive improvements before issues escalate.

By implementing these tactics and leveraging new tools and systems, banking HR leaders can improve employee retention creatively. For example, Whistle worked with a manufacturing and distribution company to enhance their onboarding experience and accelerate bonus payments. Within two months, employee retention increased